What is a Non-Recourse Loan?

🏡 Reverse Mortgage: A Safer, Smarter Way to Enjoy Retirement

If you’re 62 or older and own your home, a reverse mortgage can help you turn your hard-earned equity into tax-free cash flow(loan)—without selling, downsizing, or making monthly mortgage payments.

💰 You stay in your home, maintain full ownership, and use your equity to support the retirement lifestyle you deserve.

Unlike traditional loans, reverse mortgages come with strong protections built specifically for seniors.

🛡️ One of the most important safeguards is the Non-Recourse Guarantee—meaning you’ll never owe more than your home’s fair market value, no matter what happens to the economy or housing market.

As long as you keep up with basic responsibilities like property taxes, insurance, and home maintenance, you can stay in your home for as long as you wish—no monthly payments required( unless you want to pay).

📆 Interest is simply added to the loan balance, and repayment only happens when you move, sell, or no longer occupy the home.

📈 And here’s the good news: even with a reverse mortgage in place, your home’s value can continue to grow. In many cases, homeowners still retain significant equity over time, especially in appreciating markets.

✨ Today’s reverse mortgages are safe, regulated, and designed to empower you—not burden you.

They’re helping thousands of retirees enjoy more freedom, flexibility, and peace of mind.

📲 Let’s explore how this solution can work for you—with clarity, care, and no pressure

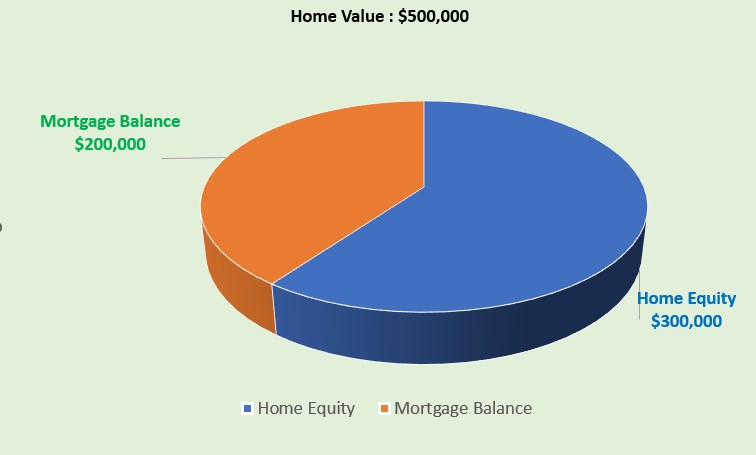

🏡 Your Home Still Holds Value—Even with a Reverse Mortgage

This chart is a simple way to show how your home’s equity remains intact—even after tapping into it through a reverse mortgage.

Let’s say your home is appraised at $500,000 and your reverse mortgage balance is $200,000.

That means you still have $300,000 in equity—your wealth, your legacy, your control.

💰 Home Value – Loan Balance = Remaining Equity

Even as you enjoy the financial freedom of accessing your home’s value, you continue to own your home and retain the equity that matters most.

Reverse mortgages are designed to give you flexibility today while preserving value for tomorrow.

📈 And as home prices rise, your equity can continue to grow—giving you and your family even more peace of mind.

Negative Equity

🛡️ Protected No Matter What—Even If Home Prices Drop

Reverse mortgages are designed with long-term security in mind—even in rare market downturns.

Let’s say after 20 years, your reverse mortgage balance grows to $400,000, but your home’s value drops to $350,000. In this scenario, your equity would technically be negative.

But here’s the reassuring part: thanks to the Non-Recourse Loan feature, you’ll never owe more than your home’s fair market value.

🏡 That means your estate or loved ones are never burdened with debt beyond what the home is worth—the lender absorbs the difference.

✅ Whether the market rises or falls, your peace of mind stays protected.

You keep full control, stay in your home, and enjoy the financial freedom you’ve earned—without worrying about future home prices.

FREE CONSULTATION

🛡️ The Safety Net That Sets Reverse Mortgages Apart

(the Home Equity Guarantee)

Unlike traditional products like HELOCs, which can leave homeowners responsible for paying back more than their home is worth, reverse mortgages come with a powerful built-in protection: the Non-Recourse Loan Guarantee.

This means that no matter what happens to the housing market or your loan balance, you’ll never owe more than your home’s fair market value.

💸 If your home value drops, the lender—not you or your family—absorbs the difference. You’re protected.

For retirees living on fixed income, this safeguard is more than just a feature—it’s peace of mind.

✅ No surprise bills. No forced sales. Just the freedom to stay in your home and enjoy the equity you’ve earned.

Reverse mortgages are designed to support your retirement—not complicate it.

📲 Let’s explore how this secure solution can help you live with confidence and control.

🛡️ Reverse Mortgage Protection: The Non-Recourse Guarantee

Even if your reverse mortgage balance ever exceeds your home’s value, you’re only responsible for the fair market value—never a penny more.

📊 In this example:

🏠 Home Value = $350,000

💳 Loan Balance = $400,000

✅ You only owe $350,000. The lender covers the rest.

This safeguard ensures your retirement stays secure, no matter what the market does.

🛡️ Peace of Mind That Lasts—Even If You Never Need It

Reverse mortgages are built with care and caution—loan amounts are conservative, and in most areas, rising home values continue to outpace loan growth. That means negative equity is very rare.

But what truly matters is the comfort this product provides.

Many homeowners love that a reverse mortgage is a “set it and forget it” solution. As long as you stay current on property taxes, insurance, and basic upkeep, you can remain in your home—without monthly mortgage payments ( you can if you want to).

And when it’s time to repay the loan, you’ll never owe more than your home’s fair market value.

✅ No surprise bills.

✅ No risk to your other assets.

✅ No burden passed on to your loved ones.

It’s a built-in guarantee that protects your future and preserves your legacy—giving you the freedom to enjoy retirement with confidence

🏡 Discover the Power of Your Home’s Equity—Without Leaving the Place You Love

Thousands of Americans over 62 are unlocking the hidden wealth in their homes through reverse mortgages—and using it to enjoy retirement with more comfort, freedom, and peace of mind.

Whether it’s:

💳 Covering everyday expenses

🎁 Providing a living inheritance to loved ones

🔧 Funding home improvements

💸 Paying off lingering debts

📈 Supplementing retirement income

☔ Setting up a line of credit for rainy days

🛏️ Covering medical or in-home care costs

✈️ Taking that long-awaited vacation

💼 Making smart investments for the future

A reverse mortgage can help you do all this—while keeping full ownership of your home and eliminating monthly mortgage payments.

✨ It’s a safe, flexible solution designed for seniors who want to make the most of what they’ve built.

To learn more or schedule a free, no-obligation consultation, feel free to reach out

Let’s explore how your home can support the retirement you deserve.

FREE CONSULTATION